On August 4, 2020, the Centers for Medicare and Medicaid Services (CMS) published the final rule for the fiscal year (FY) 2021 Inpatient Psychiatric Facilities Prospective Payment System (IPF PPS), which impacts freestanding psychiatric hospitals and excluded psychiatric units.

The regulations become effective October 1, 2020. An overview of the final rule follows.

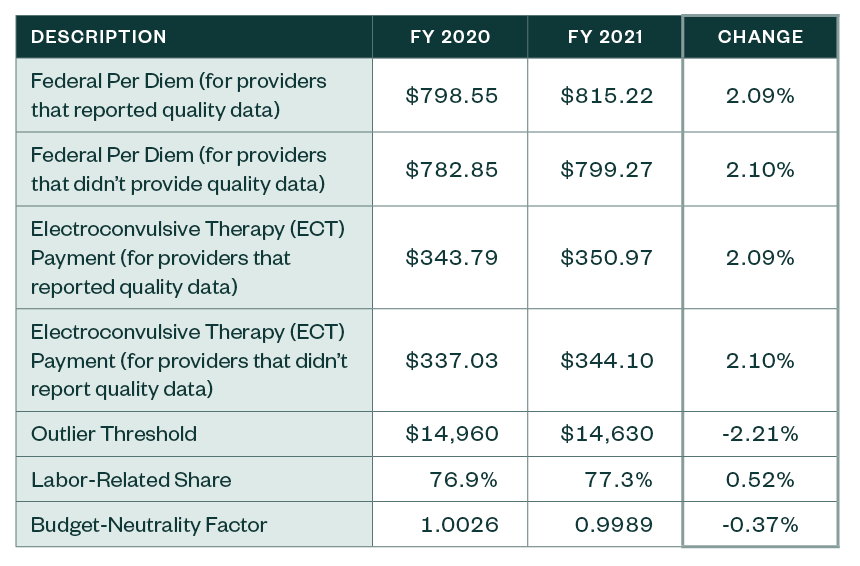

Final Changes to IPF Payments

CMS has finalized the following updates to the prospective payment rates, outlier threshold, and wage index for the IPF PPS.

IPF PPS Rates

Other Notable Updates

Core-Based Statistical Area (CBSA) Designation

CMS finalized the adoption of the most recent CBSA delineations and applies a two-year transition for all providers who would be negatively impacted by Office of Management and Budget (OMB) Bulletin 18-04.

Although the OMB issued a subsequent bulletin, Bulletin No. 20-01, it was issued too late for inclusion in this final rule.

Finalized changes from Bulletin 18-04 include the following:

- 34 counties and five providers will be considered rural. A list of these counties is included in the rule.

- 47 counties and four providers will be considered urban. A list of those counties is also included in the rule.

- Certain counties may shift between existing and new CBSAs. This change will impact 49 IPF providers, and it’s unknown if the impact will be positive or negative. A list of those counties is included in the rule.

CMS has elected to finalize a two-year transition period using a 5% cap in payment reductions. This policy was chosen in the interest of striking an appropriate balance between giving providers negatively impacted by the change time to adapt while maintaining the overall accuracy of the wage index system.

Inpatient Psychiatric Facilities Quality Reporting

There are no changes to the Inpatient Psychiatric Facilities Quality Reporting (IPFQR) program.

Economic Impact

The overall economic impact of the final FY 2021 changes equates to a $95 million increase in payments from FY 2020.

Next Steps

Providers need to review whether the appropriate IPF rates have been loaded into their patient accounting system used to bill Medicare. Once these revised rates are incorporated, best practice would be to validate that the rates are calculating appropriately. This can be accomplished by pulling a paid claim and running it through the IPF pricer that can be downloaded from the CMS website.

We’re Here to Help

For more information about the final rule, the revised rates, or assistance during the course of your validation review, contact your Moss Adams professional.